As Richmond pursues legal action against JPMorgan Chase and the Royal Bank of Canada over allegedly predatory financial deals, city officials appear to be doubling down on their support for Public Bank East Bay, a locally controlled financial institution they say will empower communities and prevent future exploitation.

The lawsuit, filed last week, accuses the banks and former financial advisors of engaging in illegal derivative contracts that cost the city tens of millions of dollars. City leaders argue that the alleged misconduct underscores the need for public banking as an alternative to Wall Street institutions.

Grandview IndependentSoren Hemmila

Grandview IndependentSoren Hemmila

In a statement about the lawsuit, Councilmember Claudia Jimenez said Richmond must have its own financial institutions and not depend on big banks that take advantage of small cities.

“I am committed to holding large entities like corporations and banks accountable so that we have the resources to invest in services that our community needs and deserves," Jimenez said.

Jimenez said she was proud to have led the charge during her first term in 2021 to analyze the city’s budget, identify costly swap agreements implemented by previous city councils, and get the city out of these contracts.

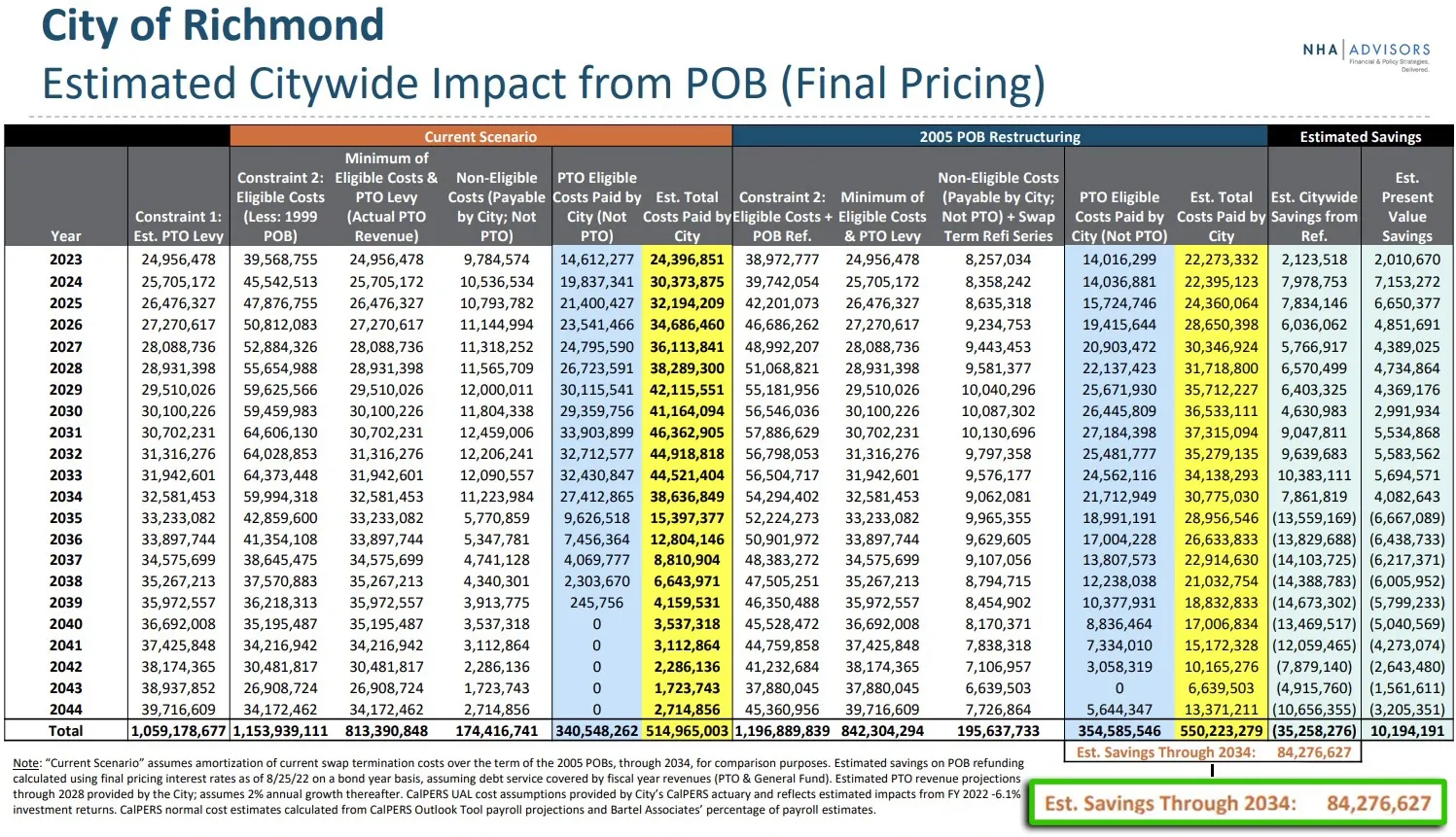

“Because of this, we saved Richmond an estimated $84 million over the next 12 years. We’ve also turned things around by refinancing some of the city’s debt, which has saved us millions and even improved our credit rating,” Jimenez said.

According to a press release from the mayor's office, Richmond is projected to save $84 million through 2034.

However, according to the Estimated Citywide Impact from the POB table, the city will face higher payments totaling $119 million from 2035 to 2044 due to the restructured debt schedule.

The city’s municipal advisors indicate the city’s recent pension debt restructuring is projected to generate significant short-term savings while shifting some costs into the future. The plan eliminates interest rate swaps tied to the 2005 Pension Obligation Bonds and restructures the debt to align with Richmond’s existing pension liabilities. As part of the agreement, the city made a one-time $22 million payment to terminate the swap contract with the Royal Bank of Canada.

Financial projections estimate $84 million in savings through 2034, offset by higher payments totaling $119 million from 2035 to 2044. However, advisors say a discounted cash flow analysis — which accounts for the time value of money —suggests a positive present value impact of over $10 million, making the restructuring financially beneficial for the city in the long run.

City officials say the restructuring is part of a broader effort to strengthen the city’s long-term financial health while maintaining flexibility for future investments. One such initiative is Public Bank East Bay, a nonprofit municipal bank backed by Richmond, Oakland, Berkeley, and Alameda County, which aims to support local economic development.

Public Bank East Bay, a nonprofit municipal bank founded by Richmond, Oakland, and Berkeley, aims to invest in local affordable housing, small businesses, and renewable energy initiatives. Unlike traditional banks, it will not take consumer deposits but instead work with community credit unions and financial institutions to distribute funds.

The initiative gained momentum when the California Public Banking Act, signed into law in 2019, allowed cities and counties to establish their own financial institutions. Richmond’s commitment to the effort was reinforced when city officials welcomed Public Bank East Bay’s newly appointed CEO, Scott Waite, a Richmond native with three decades of credit union experience.

Grandview IndependentSoren Hemmila

Grandview IndependentSoren Hemmila

“There’s a tremendous vision behind this initiative,” Waite told the council in 2023. “We are now on the cusp of finalizing key regulatory steps to make it a reality.”

Jimenez posted a photo on social media with Oscar Perry Abello, author of The Banks We Deserve – Reclaiming Community Banks for a Just Economy.

“We had an inspiring discussion about the critical role of public banks in fostering resilient economies,” Jimenez said. “Public banks can support small businesses, drive local economic growth, and keep wealth circulating within our communities. It’s time for our city to rethink how we finance our futures and create sustainable systems that work for everyone.”

In January, Mayor Eduardo Martinez joined representatives from Public Bank East Bay in Oakland to strategize to fund the bank’s launch and ensure its long-term sustainability.

The event focused on strategies to fund the bank’s launch and ensure its long-term sustainability. Discussions emphasized the need for local, resilient institutions that protect communities and uphold shared values. Public Bank East Bay said attendees explored partnerships with housing advocates, labor unions, and economic justice groups to align efforts and strengthen support.

Thanks to our subscribers, who help make this coverage possible.

If you are not a subscriber, please consider supporting local journalism with a Grandview Independent subscription. Click to see our monthly and annual subscription plans.

Copyright © 2025 Grandview Independent, all rights reserved.