Two community groups will propose raising new revenue from oil refining to improve Richmond’s financial health at the upcoming city council meeting on May 21.

The agenda item, proposed by Mayor Eduardo Martinez and Vice Mayor Claudia Jimenez, says oil refining negatively impacts the city. Communities for a Better Environment and the Asian Pacific Environmental Network have an idea of how to generate new tax revenue.

If the council approves, the item would direct the city attorney to prepare a Richmond Refining Tax Act ballot measure. The report stated that the city could use the new revenue to mitigate the negative impacts of refining.

If this idea sounds familiar, it is because it is similar to Measure T, a business license fee primarily directed at the refinery approved by Richmond voters in 2008. A judge declared the measure unconstitutional in 2009.

East Bay TimesBay Area News Group

East Bay TimesBay Area News Group

Contra Costa County Superior Court Judge David Flinn’s 2009 decision said Chevron challenges the imposition and collection of a tax, imposed as a result of a voter initiative referred to as “Measure T,” upon various grounds, one of which is that the tax, as written, interferes with interstate commerce.

“This Court concludes that the challenge is well-taken. While it would appear that the City of Richmond is capable of imposing a licensing or “doing business” tax upon the activities in Richmond of Chevron and that such tax may well have considerable similarity to the tax voted upon by the voters, the tax scheme that has been selected and put into place cannot be enforced,” Flinn wrote.

The city appealed the decisions but later came to an agreement with the oil and gas company. Chevron agreed to make payments for 15 years totaling $114 million and not to submit a circulating ballot measure to amend the Richmond Utility User’s Tax. The agreement also allowed Chevron to avoid paying additional taxes passed by voters during the 15-year term expiring on June 30, 2025,

Attorneys for CBE and APEN say, “Measure T’s faults would be easy to address now in hindsight and going forward.”

According to a report by CBE and APEN, the settlement agreement froze new taxes from being applied to the refinery while the agreement was in effect, including Measure U’s Gross Receipts Tax and changes to the User Utility’s Tax. Once the agreement expires, all city taxes will apply to the refinery as currently on the books, and the city’s ability to impose new tax liability returns free of the credit complications laid out in the agreement.

Budget woes

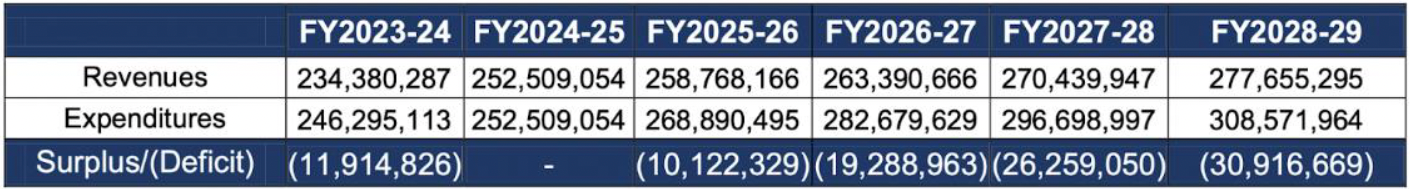

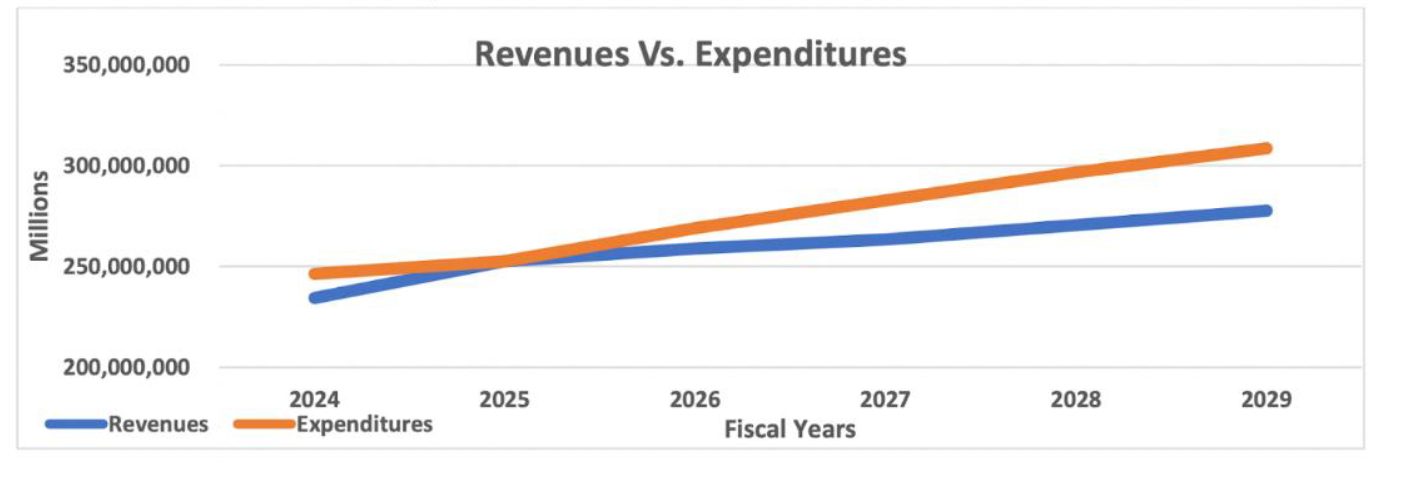

The draft Fiscal Year 2024-25 Annual Operating Budget, presented to the City Council on May 7, 2024, underscores the need for increased revenue streams. The agenda report illustrates that the general fund currently cannot meet almost $34 million in budgetary requests from city departments.

According to the agenda report, the proposed annual operating budget for the fiscal year 2024-25 underscores the need for increased revenue streams. A “Middle of the Road” financial forecast indicates within the next two years, the City of Richmond will not be able to achieve a balanced budget without increased revenue streams.

The city also faces budgetary needs that it cannot fund but must prioritize. Staff turnover and low staffing levels affect city finances and economic development. The city finds it difficult to afford the staffing it needs to provide quality services.

For example, the city’s pavement network is degrading each year; even preventing further degradation requires millions more each year in budgetary allocations.

Grandview IndependentSoren Hemmila

Grandview IndependentSoren Hemmila

Ongoing negative externalities

According to the report, the city and its residents face harmful impacts from oil refining, including public health and environmental impacts and additional stresses on emergency services.

“With respect to public health, particulate matter from the refinery alone is linked to 5 to 11 premature deaths in Richmond each year. The federal EPA estimates that the health impacts of oil refining in Contra Costa County range from $70 million to $140 million annually,” the report stated. “Proximity to a pollutive industrial facility causes negative impacts, including health issues and emergency services strain. Oil refining alone is linked to premature deaths, and health impacts cost millions annually.”

Also on the agenda: two more holidays for city employees

A resolution to adopt Cesar Chavez Day and Juneteenth as official city holidays is on the consent calendar. The estimated fiscal impact of two paid holidays for all bargaining units is approximately $1.6 million.

“The City of Richmond strives to be an employer of choice and recognizes the value city staff provide to our community. Cesar Chavez Day and Juneteenth holidays serve as an opportunity to honor historical figures and events that have significantly shaped our society,” according to the report.

Tobacco retailer moratorium

The promised 10-month extension of a temporary moratorium on new permits, licenses, or entitlements for any new tobacco retailer in the city is on the back on the agenda.

The Richmond City Council approved a 45-day moratorium on new tobacco retailers in April after public outcry over an increasing number of smoke shops opening in the city.

Grandview IndependentSoren Hemmila

Grandview IndependentSoren Hemmila

Click to become a Grandview Supporter here. Grandview is an independent, journalist-run publication exclusively covering Richmond, CA. Every cent we make funds reporting from Richmond's neighborhoods. Copyright © 2024 Grandview Independent, all rights reserved.